OPEC+ oil producers are likely to agree output cuts of at least 1 million barrels per day (bpd) for early next year led by Saudi Arabia rolling over its voluntary additional cut and smaller curbs by others, two delegates told Reuters ahead of a virtual OPEC+ meeting on Thursday.

OPEC Feed Atom

OPEC+ is continuing to hold talks on 2024 oil policy, with no delay to a meeting scheduled for Thursday currently expected, two sources from the producer group said on Wednesday.

OPEC Secretary-General, Haitham Al Ghais, on Monday accused the International Energy Agency of vilifying the oil and gas industry, in the latest clash between the groups over climate policy, Reuters reports.

The implementation of Nigeria’s 2024 budget will this week face a major test as negotiations between the country and the Organisation of Petroleum Exporting Countries (OPEC) to raise oil output allocation for next year continue.

OPEC+ is close to resolving a dispute over output quotas that forced the group to postpone a pivotal meeting, as it reviews the demands made on African members by an earlier deal.

OPEC's share in India's oil imports in October hit a 10-month high as refiners bought more crude from Saudi Arabia and the United Arab Emirates after discounts narrowed for Russian oil that month, trade data showed.

OPEC+ has delayed its ministerial meeting to set output policy to Nov. 30 from Nov. 26 as previously scheduled, OPEC said in a statement on Wednesday.

India, the world's third largest oil consumer, has asked oil producers cartel OPEC to maintain and ensure market stability for the benefit of consumres, producers and global economy.

Iran produced 3.115 million barrels per day (bpd) of crude oil in October, registering a 46,000-bpd increase compared to the previous month, according to OPEC’s latest monthly report.

OPEC on Monday said oil market fundamentals remained strong and blamed speculators for a drop in prices as it slightly raised its 2023 forecast for global oil demand growth and stuck to its relatively high 2024 prediction.

Oil prices gained about 2% on Friday as Iraq voiced support for OPEC+’s oil cuts ahead of a meeting in two weeks and as some speculators covered massive short positions ahead of weekend uncertainty.

RoydadNaft – OPEC+ crude oil output grew 180,000 b/d in October, the latest Platts survey by S&P Global Commodity Insights found, adding supply pressures to…

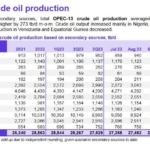

OPEC+ crude oil output grew 180,000 b/d in October, the latest Platts survey by S&P Global Commodity Insights found, adding supply pressures to flagging market sentiment, as Iran and Iraq led the group's production higher.

U.S. waterborne imports of crude from OPEC+ members including Saudi Arabia have dropped steadily over the last year, further tightening supplies in the U.S. while supporting other markets including Europe, according to flows data and analysts.

OPEC is not planning to hold an extraordinary meeting or take any immediate action after Iran's foreign minister called on members of the Organisation of Islamic Cooperation (OIC) to impose an oil embargo and other sanctions on Israel, four sources from the producer group told Reuters.

The gap between two leading oil forecasters' views on 2024 demand growth widened on Thursday, with the International Energy Agency (IEA) predicting a sharper slowdown while producer group OPEC stuck to expectations for buoyant China-led growth.

OPEC’s crude oil production witnessed a noticeable uptick in September as compared to August, as per the latest data released in the Monthly Oil Market Report (MOMR) published by the organization.

OPEC on Thursday stuck to its forecast for relatively strong growth in global oil demand in 2023 in 2024, citing signs of a resilient world economy so far this year and expected further demand gains in China.

Iran’s Oil Minister Javad Owji on Wednesday said unity between member states of OPEC and OPEC+ alliance has led to producers’ desirable consensus on supply and stability of world market and prices.

Russian President Vladimir Putin said on Wednesday that coordination by the OPEC+ group of leading oil producers would continue to ensure predictability on the oil markets.