Russia remained China's top oil supplier in March, data showed on Saturday, as refiners snapped up stranded Sokol shipments.

OIL Feed Atom

Since taking office in August 2021, the 13th administration has been able to attract 11.6 billion dollars of foreign investment of which 4.8 billion dollars have been allocated to the oil and gas mega projects.

TENCO will implement 2-dimensional and 3-dimensional seismic operations in the north and northwestern of Iran over a two years period based on a contract signed on Tuesday, April 16.

The expansion of Canada’s Trans Mountain oil pipeline is nearly ready for action after years of delays and billions of dollars in cost overruns.

Russia became the top oil supplier to India during the fiscal year 2023/24 for a second year in a row, squeezing the market share of Middle Eastern and OPEC producers to historic lows, ship tracking data from industry sources showed.

Brent futures were down 48 cents, or 0.6%, at $86.63 a barrel by 1155 GMT. The most active U.S. West Texas Intermediate contract was down 38 cents, or 0.5%, to $82.35.

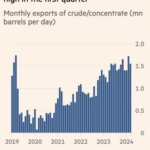

Iran is exporting more oil than at any time for the past six years, giving its economy a $35bn-a-year boost.

India's crude oil imports remained flat in the fiscal year 2023/2024 ended March 31, but the import bill of the world's third-largest oil importer fell by almost 16% due to lower oil prices and record-high imports of cheaper Russian crude.

Venezuela plans to continue business with foreign firms, including PDVSA joint venture partners, even after the expiration of a U.S. license allowing free crude export.

Brent futures were down 60 cents, or 0.7%, at $86.69 a barrel, while U.S. crude futures traded 53 cents lower, or 0.6%, at $82.16 a barrel at 1135 GMT. Both were down for a fourth straight session.

House Speaker Mike Johnson’s national security supplemental legislation released Wednesday includes new sanctions to prevent Iran from selling its oil.

Canada will provide up to C$5 billion ($3.6 billion) in loan guarantees to help Indigenous groups invest in natural resource projects, the Liberal government said in its annual budget on Tuesday.

Brent futures for June were down $1.21, or 1.3%, to $88.81 a barrel at 1330 GMT, while U.S. crude futures for May were down $1.11, or 1.3%, to $84.25 a barrel. Both were on track for their biggest fall since March 20 if losses hold.

The U.S. Energy Information Administration (EIA) has announced in its latest report that Iran produced 3.25 million barrels per day (bpd) of oil in March 2024, 20,000 bpd more than the previous month.

A Reuters report on Tuesday said the Biden administration is unlikely to take any dramatic sanctions action on Iran's oil exports after Iran’s response to Israel, due to worries about boosting oil prices and angering top buyer China.

Iran’s oil minister said on Wednesday semifinished projects worth more than $28 billion were completed in the Iranian calendar year of 1402 (March 21, 2023-March 19, 2024).

Iran’s Plan and Budget Organization (PBO) chief said on Tuesday the Oil Ministry has managed to thwart the sanctions aimed at limiting the country’s oil production and sales in the international market.

Iran, the third largest producer in the Organization of the Petroleum Exporting Countries (OPEC), produces about 3 million barrels of oil per day (bpd), or around 3% of total world output.

Brent futures for June delivery fell 33 cents, or 0.4%, to $89.77 a barrel by 1140 GMT. U.S. crude for May slipped 38 cents, or 0.4%, to $85.03.

Russia has been able to swiftly repair some of key oil refineries hit by Ukrainian drones, reducing capacity idled by the attacks to about 10% from almost 14% at the end of March, Reuters calculations showed.