China’s independent refiners have increased their crude imports from Iran by 4.3 percent in June to an eight-month high of around 6.1 million metric tons.

OIL Feed Atom

A visit to Russia by Indian Prime Minister Narendra Modi, expected within days, could help dispel worries that New Delhi is getting too close to the West and further away from Moscow, ceding space to China, analysts said.

Brent crude futures were down 43 cents, or 0.49%, at $86.91 a barrel by 0855 GMT while U.S. West Texas Intermediate (WTI) crude futures fell 49 cents, or 0.58%, to $83.39 in trade thinned by the U.S. Independence Day holiday.

While the enemy has announced clearly that it has failed to prevent Iran from selling its crude oil, some call it into doubt at home, the spokesman of the Iranian government Ali Bahadori-Jahromi announced.

Iranian Minister of Petroleum Javad Owji says that Iran’s foreign exchange revenue from exporting crude, gas condensate, oil products, and petrochemicals rose 3.5 times during the 13th administration in office since August 2021.

Brent crude futures edged up 46 cents, or 0.5%, to $86.70 per barrel at 0645 GMT. U.S. West Texas Intermediate crude futures climbed 42 cents or 0.5% to $83.23 per barrel.

Iran has risen to become the fourth largest oil exporter within the Organization of the Petroleum Exporting Countries (OPEC) due to a surge in oil production and sales.

Oil sector growth was announced as positive over the first three months of the current Iranian calendar year of 1403, which began on March 21.

Brent crude futures rose 28 cents to $86.88 per barrel. West Texas Intermediate (WTI) crude rose 20 cents to $83.58 a barrel, after gaining 2.3% to its highest since April 26.

Transport Canada has taken action to address the environmental impacts of marine shipping by implementing a ban on heavy fuel oil (HFO) use by vessels in the Arctic.

India’s government-owned energy company Oil & Natural Gas Corporation (ONGC) has placed two orders deemed “large” with compatriot company Larsen & Toubro related to subsea work.

Brent crude futures rose 53 cents, or 0.6%, to $85.53 a barrel by 0729 GMT, while U.S. West Texas Intermediate crude futures were at $82.05 a barrel, up 51 cents, or 0.6%.

Figures by the European Union’s statistics agency, Eurostat, show that Turkey resumed importing oil from Iran in March this year nearly four years after it cut shipments to zero to comply with US sanctions on Tehran.

Iran has overtaken Kuwait and Nigeria to be the fourth largest crude/condensate exporter of OPEC.

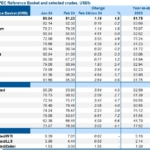

The weekly price of the OPEC basket of twelve crudes rose by 13 cents during the week ending on June 27.

Brent crude futures for August settlement, on Friday, rose 48 cents, or 0.56% to $86.87 a barrel. U.S. West Texas Intermediate crude futures for August delivery rose 52 cents, or 0.64%, to $82.26 a barrel.

Top oil exporter Saudi Arabia may cut prices for crude grades it sells to Asia for a second month in August, tracking weakness in Middle East benchmark Dubai, trade sources said on Friday.

Brent crude oil futures were up 43 cents, or 0.5%, at $85.68 a barrel by 0850 GMT. U.S. West Texas Intermediate crude futures rose 42 cents, or 0.5%, to $81.32.

Iranian Minister of Petroleum, Javad Owji, says that the country’s oil production has risen by 60 percent over the three past years of Ibrahim Raisi’s administration in office.

The managing director of the National Iranian Oil Company (NIOC) has said that Iran’s oil revenues rose by 300 percent during the 13th administration in office since August 2021.