Iran’s biggest contracts in the past decade worth over $13 billion will be signed in the presence of Oil Minister Javad Owji and National Iranian Oil Company (NIOC) Managing Director Mohsen Khojastehmehr.

BREAKING NEWS Feed Atom

TotalEnergies was preparing on Friday to restart the gasoline-producing fluidic catalytic cracker (FCC) over the weekend at its 238,000 barrel-per-day (bpd) Port Arthur, Texas refinery, said people familiar with plant operations.

The Indian government has raised its windfall tax on petroleum crude to 4,900 rupees ($59.15) a tonne from 4,600 rupees with effect from March 16, according to a government notification released on Friday.

The oil and gas sector’s growth in the first nine months of the Iranian calendar year (starting March 21, 2023) surged beyond 16 percent, said the Central Bank of Iran (CBI) governor.

The oil tanker NS Century, which is under sanction by the United States, arrived at the Chinese port of Qingdao late on Thursday to discharge its cargo of Russian crude oil, LSEG shipping data showed.

Brent crude oil futures were down 45 cents or 0.6% to $84.83 a barrel at 1155 GMT, a day after topping $85 a barrel for the first time since November. U.S. West Texas Intermediate (WTI) crude was down 47 cents or 0.6% to $80.70.

The United States has asked Panama to prevent Iranian ships from using its flag in yet another attempt by Washington to press other nations to implement its unilateral anti-Iran sanctions.

The Iraqi Minister of Electricity says Baghdad is negotiating with Tehran to use Iran's wide and nationwide lines to transport Turkmenistan's gas.

The Gas Exporting Countries Forum (GECF) officially launched the new edition of its annual flagship publication, the Global Gas Outlook (GGO), on 12 March 2024 in the GECF Secretariat via video conference.

Saudi -listed ADES Holding Company said a vacuum in attractive markets such as India and Southeast Asia could largely offset potential excess supply in Saudi Arabia.

Brent crude futures for May rose 70 cents, or 0.83%, to $84.73 a barrel by 1346 GMT. U.S. West Texas Intermediate (WTI) crude for April was up 88 cents, or 1.1%, at $80.60.

Iran’s deputy oil minister estimated the country’s petrochemical exports will reach 29 million tons by the end of the current Iranian calendar year (March 19, 2024).

The head of the Qeshm Free Zone Organization said Chinese investors welcome the investment packages introduced at Iran’s free trade-industrial zones, Tasnim News Agency reported.

Brent crude futures for May rose $1.06, or 1.3%, to $82.98 a barrel by 1104 GMT. U.S. West Texas Intermediate crude for April gained $1.15, or 1.5%, to $78.71.

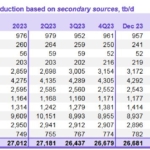

The Monthly Oil Market Report (MOMR) of the Organization of the Petroleum Exporting Countries (OPEC) showed that Iran has regained its position as the third-largest crude oil producer in February.

Brent futures for May delivery rose by 21 cents to $82.42 a barrel at 11:50 a.m. EDT (1550 GMT). The April U.S. West Texas Intermediate (WTI) crude contract rose 31 cents to $78.24.

OPEC on Tuesday stuck to its forecast for relatively strong growth in global oil demand in 2024 and 2025, and further raised its economic growth forecast for this year saying there was more room for improvement.

The contracts signed between the Iranian companies to boost pressure in the joint South Pars (SP) gas field showed that sanctions have failed to prevent Iran’s oil and gas industry from making progress, said a member of the Parliament on Tuesday.

The head of Iranian Gas Engineering and Development Company (IGEDC) has said the country’s first gas refinery with a fully Iranian-made control system is going to go operational early next year (starts in late March), IRNA reported.

Brent futures for May delivery settled at $82.21 a barrel, gaining 13 cents. The U.S. crude April contract slipped 8 cents to end at $77.93 a barrel.