U.S. Sanctions Are Squeezing India’s Russian Oil Imports

RoydadNaft – India’s dependence on Russian oil has grown significantly since the 2022 Ukraine invasion, and the new sanctions could lead to higher inflation and supply disruptions.

The 2022 Russian invasion of Ukraine and subsequent sanctions on Russian energy led to widespread gas shortages and stopped Russia from selling its crude to the U.S., Europe, and several other countries worldwide. The sanctions were aimed at hindering Russia’s economic might and encouraging Putin to bring an end to the war, which has not yet happened. While most countries shifted their dependence away from Russian energy, some states decided to ignore the sanctions and purchase Russian crude at a discounted rate, including China and India. However, with additional sanctions coming into place, buying cheap Russian oil may no longer be possible for Asian countries.

The U.S. has introduced stricter sanctions on Russia’s energy companies and tanker operators starting in March, which could make it more difficult for India to continue importing cheap Russian crude. In January, the U.S. Treasury launched new sanctions on two Russian oil and gas companies, in addition to 183 tankers. This move could drive up inflation in the South Asian state as it is forced to buy more expensive energy. A 2019 assessment from the Reserve Bank of India suggested that each $10 per barrel price increase in oil could lead to a 0.4 percent rise in headline inflation. Bob McNally, the president of Rapidan Energy Group, stated, “India will be more affected than China by sanctions since India imports a much greater amount of its oil from Russia than China.”

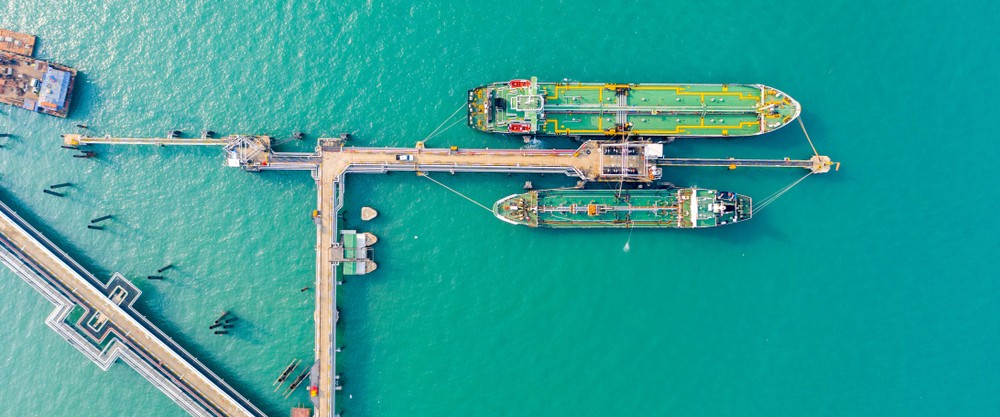

India imported around 88 percent of its oil needsbetween April and November 2024, with around 40 percent coming from Russia. A reported 75 of the 183 sanctioned tankers have delivered Russian crude to India. In 2024, 30 percent of the oil shipped on the 183 tankers was earmarked for India. Much of this crude was delivered to Indian refiners. There are also concerns that the new Donald Trump government may introduce stricter sanctions on Irani oil, another major supplier of crude to India, which could push the price of crude up worldwide.

India’s oil consumption has been growing rapidly, in line with population growth and industrialization. It is expected to surpass that of China in 2025, with an increase of around 330,000 bpd, according to the U.S. Energy Information Administration (EIA). India contributes around 25 percent of the total oil consumption growth globally. Meanwhile, China’s liquid fuel consumption is expected to grow by 250,000 bpd in 2025. India consumed 5.3 million barrels each day in 2023, according to the EIA.

Before the war drove the price of Russian crude down, India imported just 12 percent of its oil from Russia. As stricter sanctions were introduced on Russian oil, Putin discounted the country’s fuels further, and Urals was sold for around $12 per barrel less than the global Brent benchmark and $4 per barrel cheaper than Iraqi oil.

The new sanctions will make it more expensive for Russia to ship crude and place more restrictions on tanker movements. The Biden administration introduced stricter sanctions on Russia’s oil and gas industry to help President Zelensky and the incoming Trump administration broker a peace deal between Russia and Ukraine. Kremlin spokesman Dmitry Peskov stated of the move, “It is clear that the United States will continue to try to undermine the positions of our companies in non-competitive ways, but we expect that we will be able to counteract this.”

Peskov also warned that the stricter sanctions may destabilize global markets. “Such decisions cannot but lead to a certain destabilization of international energy markets, oil markets. We will very carefully monitor the consequences and configure the work of our companies in order to minimize the consequences of these … illegal decisions,” he said.

The new sanctions may cause a supply disruption to India as high as 500,000 bpd. However, Russia is expected to attempt to circumvent the sanctions, as it has done previously. In addition, it is not clear whether China and India will adhere to the U.S. sanctions.

Lyudmila Rokotyanskaya at Russia’s BCS brokerage said that new sanctions will likely disrupt crude exports for several months, encouraging Russia to further discount its Urals. However, she expects Russia’s shadow fleet of around 800 tankers to continue working to bypass international sanctions. One trader in Russian oil stated, “I think that within three to six months companies will find a way out of the situation, but the short-term prospects are a cause for concern.”

Despite the far-reaching sanctions on Russian energy, Putin has found several ways to circumvent U.S. restrictions and continue selling its oil at a discounted rate to several countries worldwide – most notably China and India. With new stricter sanctions coming into place in March, it could further limit the export of Russian crude. However, this will largely depend on Russia’s ability to continue shipping oil under the radar, through clandestine activities, and the willingness of import countries to adhere to the new sanctions.