India’s oil products demand growth set to move to higher trajectory after Oct recovery

RoydadNaft – India’s oil product demand reversed a period of negative growth and posted a close to 3% year-over-year rise in October as the monsoon season ended, a trend that is set to continue in November on the back of higher vehicle sales during the festival period and robust demand from the agricultural sector.

While the start of the marriage season toward the end of November could support overall demand for transportation fuels, holiday travel in December could also present good news for jet fuel, analysts and industry sources told S&P Global Commodity Insights.

“Oil demand in November is set to be bolstered further, after strong vehicle sales that we saw during the festive periods of Navratri and Diwali in October. This is expected to enhance transportation fuel consumption,” said Himi Srivastava, South Asia oil analyst at Commodity Insights.

Retail vehicle sales increased by 32% year over year and 64% month over month in October. All categories experienced healthy year-over-year growth — two-wheelers at 36%, three-wheelers at 11%, passenger vehicles at 32%, tractors at 3%, and commercial vehicles at 6%, according to Commodity Insights.

“Additionally, October and November are set to witness heightened activity in the agricultural sector, along with a resurgence in construction and mining activities, which typically slow down during the monsoon season,” Srivastava added.

Diesel demand aids recovery

Latest data from the Petroleum Planning and Analysis Cell showed that India’s oil product demand rose 2.9% year over year to 20.04 million mt, or 5.1 million b/d, in October. These numbers represented an 11.7% month-over-month growth, driven mainly by diesel demand that rose 19.9% over the same period.

“Refineries are very much preparing for the revival in demand in the coming months. We will see most refineries maintaining higher runs toward the end of the year, as demand is on a path of recovery after a long period of subdued growth, thanks to the four-month monsoon season,” said one refining source.

Indian refineries processed 5.2 million b/d of crude oil in September, according to the latest oil ministry data, up 4.8% year over year.

The combined runs of all refineries — including both state-run and private refineries — were 2% higher in September than the 5.1 million b/d of crude processed in August. Analysts attributed this to the conclusion of the maintenance season for refineries, while refiners prepared for the end of the monsoon season.

“Domestic oil demand is expected to rise until December on overall improvement in economic activities,” a senior petroleum ministry official said.

The monsoon season, typically from June to September, saw rainfall that was 8% above the long-term average in 2024, causing infrastructure damage across the country. The southwest monsoon withdrew on Oct. 15, while the northeast monsoon began five days earlier, likely bringing above-average rainfall to the southern peninsula and eastern regions in October and November.

Upward momentum

According to Commodity Insights, India’s oil demand is projected to increase by 4.5% in November, before slowing to 2% in December, compared with the previous year. The overall demand growth for Q4 is set to average 3% year over year.

“An estimated 4.5 million weddings are planned this year, spanning approximately 45-50 days starting mid-November. This is likely to boost road fuel consumption. As December approaches, northern India experiences colder weather, potentially reducing driving activity if foggy conditions arise. However, the year-end holidays are expected to support demand, including for jet fuel,” Srivastava added.

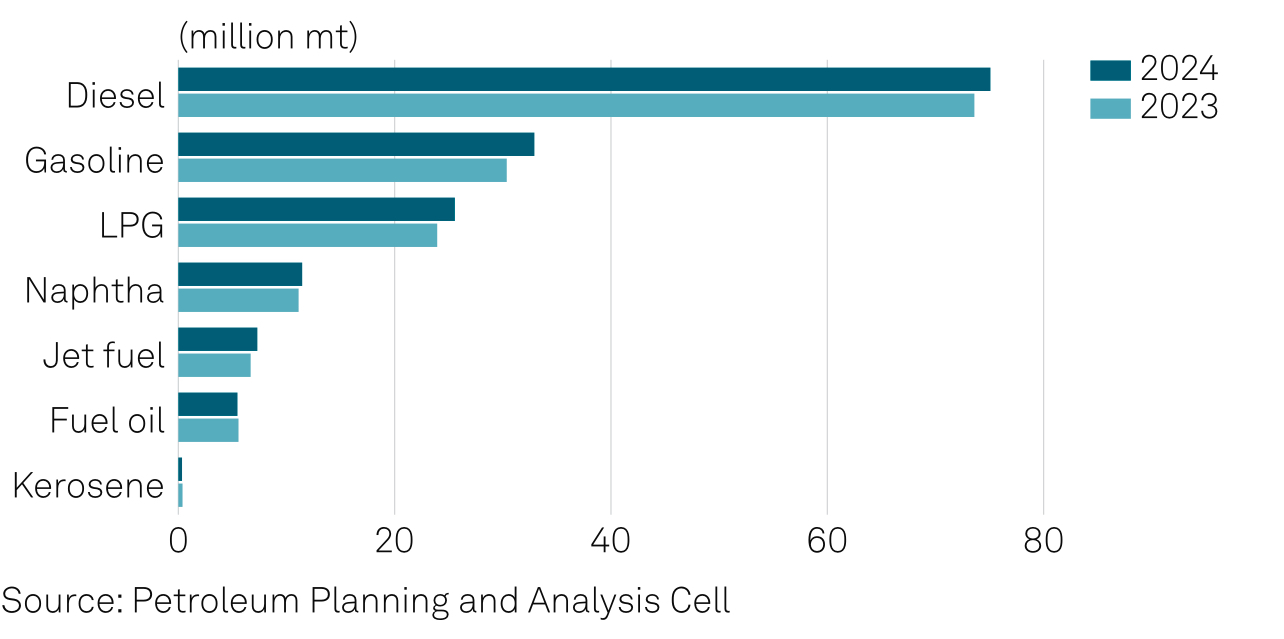

Over January-October, India’s oil product demand rose 2.8% year over year to 197.51 million mt, or 5.1 million b/d. Demand for diesel and gasoline rose 2% and 8.4% during the 10-month period while LPG and jet fuel demand grew by 6.8% and 9.3%, respectively, over the same period.

India’s oil products demand in the Jan-Oct period

In 2023, India’s oil product demand had risen 4.7% year over year to 230 million mt, or 4.9 million b/d, Petroleum Planning & Analysis Cell data showed, reflecting gains from lower crude prices after the oil market discounted the impact of the Russia-Ukraine war on global oil supplies.

Crude oil futures settled higher on Nov. 18 against a backdrop of potential escalation in Russia-Ukraine tensions. NYMEX December WTI settled $2.25 higher at $69.17/b, and ICE January Brent climbed $2.26 to $73.30/b. A geopolitical risk premium returned to the market Nov. 18 amid reports that US President Joe Biden allowed Ukraine to use US-supplied long-range missiles to strike deep into Russia.

Indian oil ministry officials said they were keeping a close eye on global crude prices as any sharp surge had the capability to trigger demand destruction. At the same time, they added that they were hopeful of a reduction in geopolitical tensions in the coming months.

“I think we are on a good wicket now. Stability and oil prices depend both on the availability and the global geopolitical situation. But as I said, all things being equal, if there is more oil coming on the market and if the global situation also eases, then we can hope for a more predictable assessment,” said Hardeep Singh Puri, minister of petroleum.