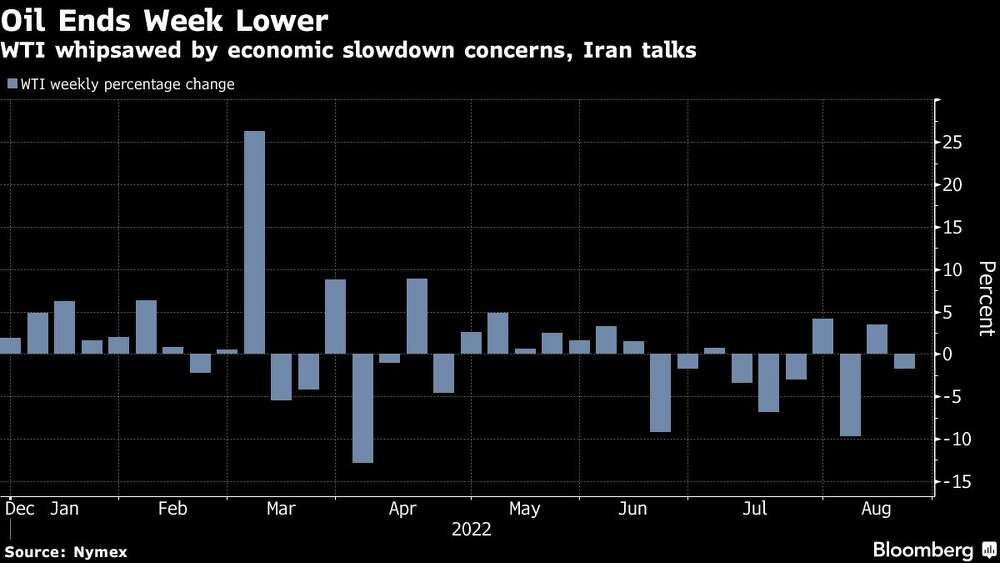

Oil falls to seven-month low this week over slowdown worries

Continued worries about the global economy sent crude prices to their lowest level since January despite signs of improving US demand.

West Texas Intermediate on the New York Exchange rose three of five trading days, overcoming steep drops of $2.60 Monday and $2.88 Tuesday that sent prices below $90 a barrel. Prices then gained $1.58 Wednesday and $2.39 Thursday, sending prices back above $90 a barrel. Prices added 27 cents Friday to close the week at $90.77. That’s still below the $92.09 at last Friday’s close. The posted price ended the week at $87.25, according to Plains All American.

Natural gas prices spent most of the week above the $9 per Mcf, driven higher by signs that inventories continue below historic levels. Prices jumped 60 cents Tuesday $9.33 per Mcf, a level not seen in 14 years before falling about 15 cents Wednesday and Thursday and then rising 15 cents to end the week at $9.336.

Craig Erlam, senior market analyst, UK and EMEA at Oanda, speculated in the company’s daily newsletter that prices may be stabilizing.

“The list of downside risks has definitely grown lately, with growth certainly top of it,” he wrote. “Iran nuclear talks have not collapsed yet which remains another potential negative for crude prices given the reported potential for a large amount of crude to come to the market relatively soon.

“We may be seeing oil prices stabilizing around these levels, with Brent hovering above $92 and WTI choppy around $90. I can’t imagine it will last long considering how the rest of the year has gone with a conclusion on the Joint Comprehensive Plan of Action – better known as the Iran nuclear deal – talks probably having an impact one way or another.”

Ed Longanecker, president of the Texas Independent Producers and Royalty Owners Association, told the Reporter-Telegram by email that despite the decline in prices from their eight-year highs, supply and demand fundamentals will likely drive prices higher this year.

“Increased output from OPEC+ will likely be less than projected and will be offset by the EU cutting Russian imports,” he wrote. “Higher prices for coal and natural gas should drive increased demand for oil, China demand will inevitably increase, and as the SPR release winds down in an undersupplied global market, few options exist if we experience additional supply disruptions.”

Steve Hendrickson, president of Ralph E. Davis Associates, wrote in his weekly update the run-up in prices had been accompanied by a “strongly backwardated forward curve that suggested market participants didn’t expect the price increase to last very long.”

He cited the International Energy Agency’s August oil market report that listed three reasons for the recent oil price decline:

- World oil production hit a post-pandemic high of 100.5 million barrels a day

- Russian exports have fallen marginally – less than 10%– as other countries have absorbed about two-thirds of the 2.2 million barrels a day of Russian oil that Europe, the US, Japan and Korea have stopped buying

- Higher gasoline prices reduced summer driving demand.

Hendrickson also cited China’s faltering economy and its aggressive zero-COVID policy that has led to frequent lockdowns that are taking an economic toll.